Investors

- Corporate

- Investors

Chronology of Stock Listing

| Period | Month | Price (Rp) | Trading Volume (thousand shares) | Number of Shares Outstanding (shares) | Market Capitalization (Rp) | ||

| Highest | Lowest | Closing | |||||

| Fourth Quarter, 2024 | November | 322 | 128 | 234 | 2.603.795,40 | 3.250.000.000 | 760.500.000.000 |

| December | 270 | 185 | 198 | 600.719,60 | 3.250.000.000 | 643.500.000.000 | |

| Quarter IV | 322 | 128 | 198 | 3.204.515 | 3.250.000.000 | 643.500.000.000 | |

| FINAL COURSE | 322 | 128 | 198 | ||||

Stock Overview

| Period | Month | Price (Rp) | Trading Volume (thousand shares) | Number of Shares Outstanding (shares) | Market Capitalization (Rp) | ||

| Highest | Lowest | Closing | |||||

| Fourth Quarter, 2024 | November | 322 | 128 | 234 | 2.603.795,40 | 3.250.000.000 | 760.500.000.000 |

| December | 270 | 185 | 198 | 600.719,60 | 3.250.000.000 | 643.500.000.000 | |

| Quarter IV | 322 | 128 | 198 | 3.204.515 | 3.250.000.000 | 643.500.000.000 | |

| FINAL COURSE | 322 | 128 | 198 | ||||

Annual Report 2024

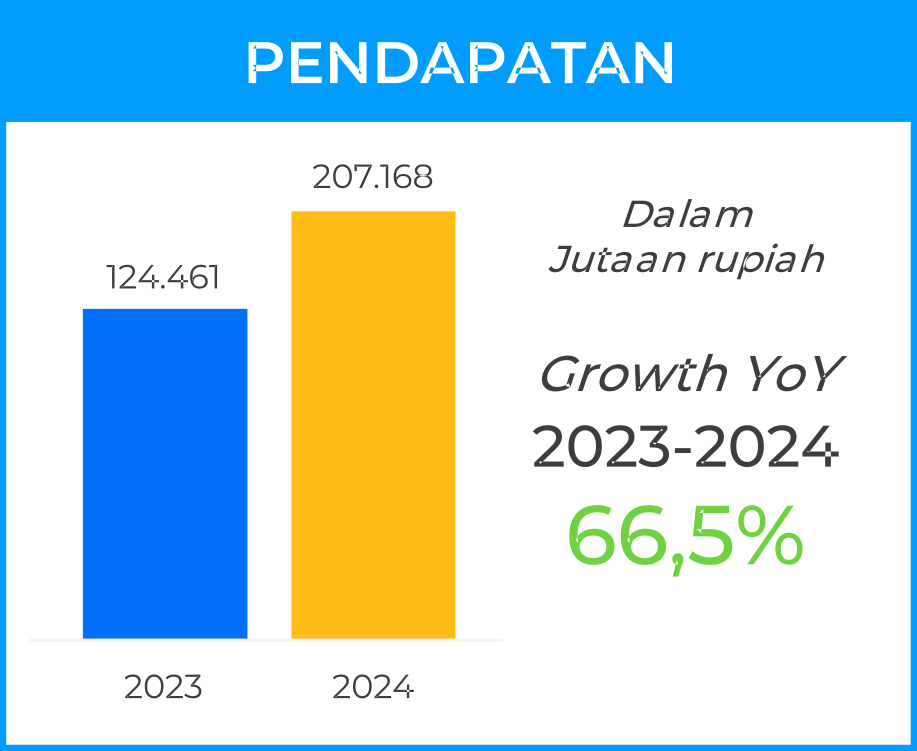

The Company’s significant achievement is in the form of revenue of IDR 207,168 billion throughout 2024. This success shows the company’s commitment to maintaining sustainable business growth amidst increasingly tight industrial competition.

In the latest financial report, the Company recorded revenue growth of IDR 207,168 billion, up 66.45% from the previous year, reflecting operational efficiency and increasing demand for the company’s services.

PT Adiwarna Anugerah Abadi Tbk presents its sustainability report for the financial year ending December 31, 2024. This report is part of our commitment to Environmental, Social, and Governance (ESG) principles, which outlines our approach to assessing, monitoring, and disclosing our sustainability efforts.

Through this report, we aim to promote transparency and accountability to our stakeholders. We hope this report will provide comprehensive information about our sustainability performance, as well as the challenges and opportunities we face in achieving our sustainability goals.

Annual Report 2025

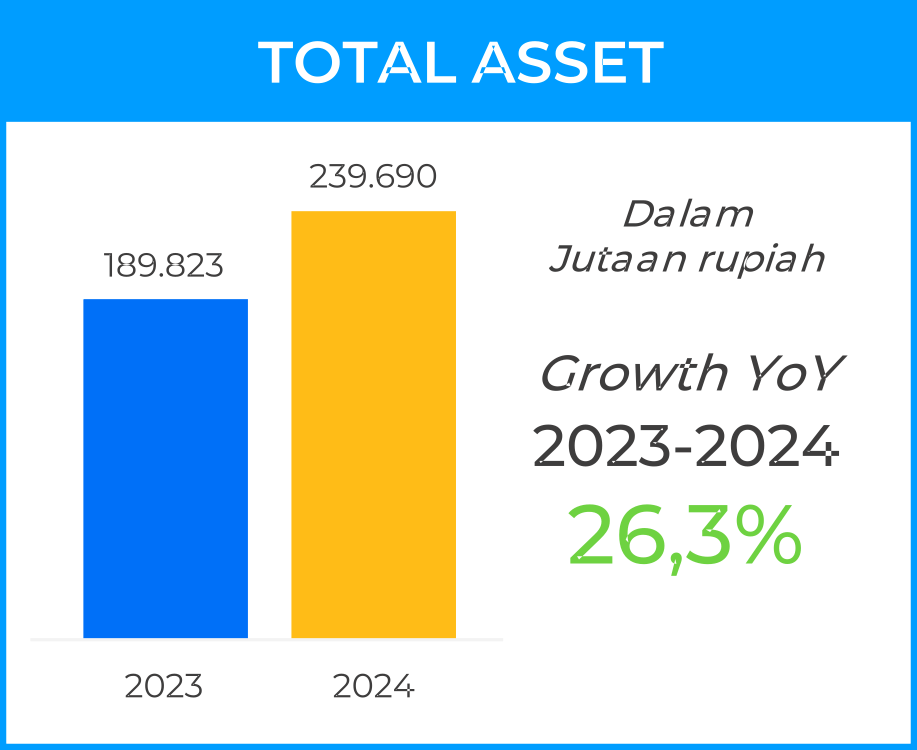

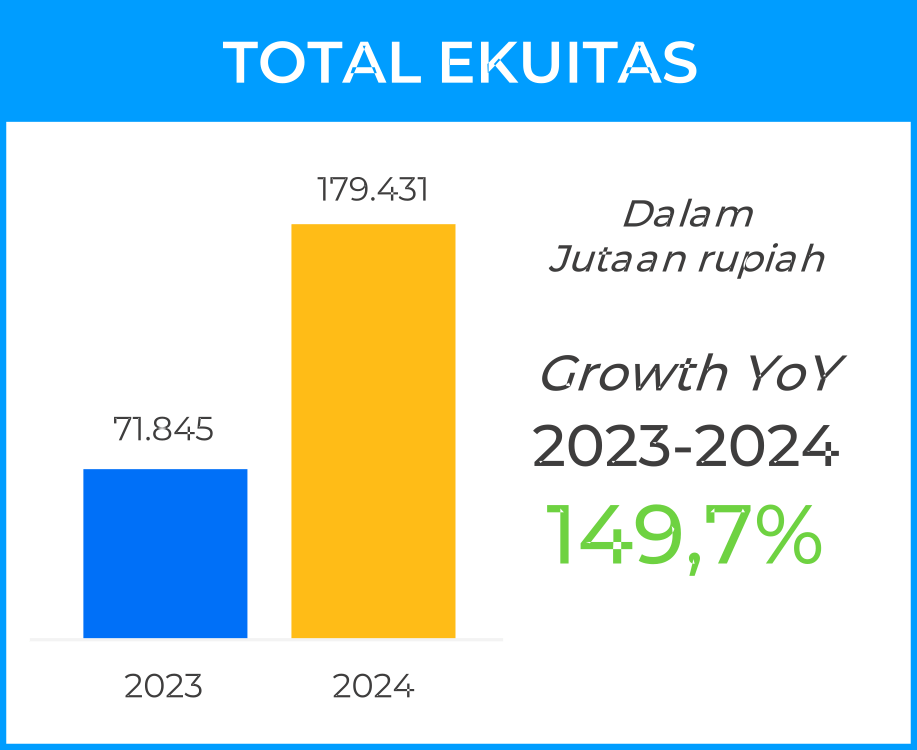

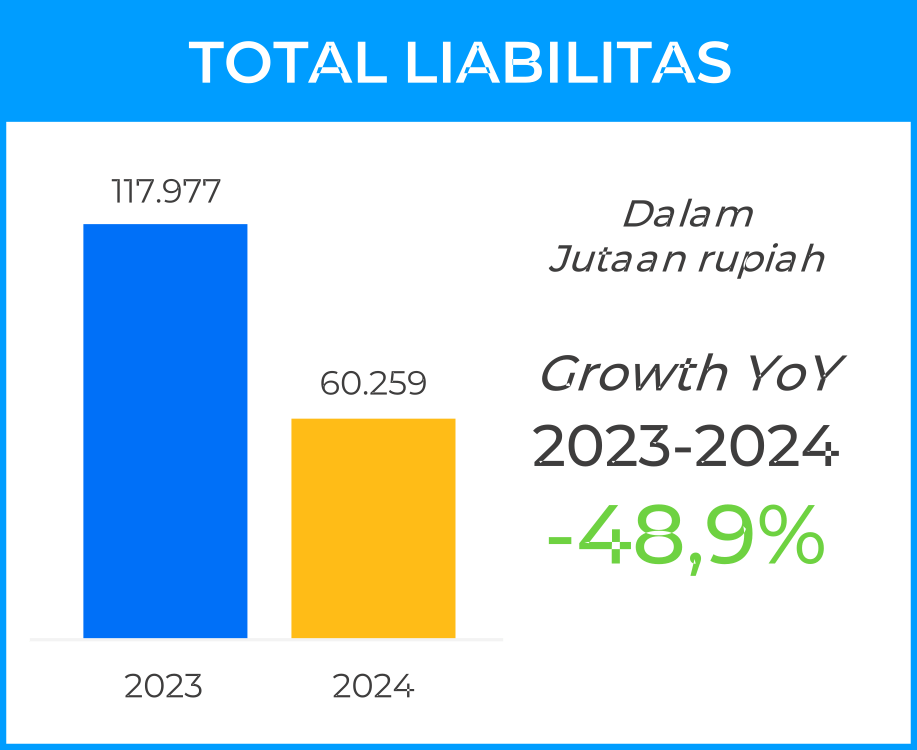

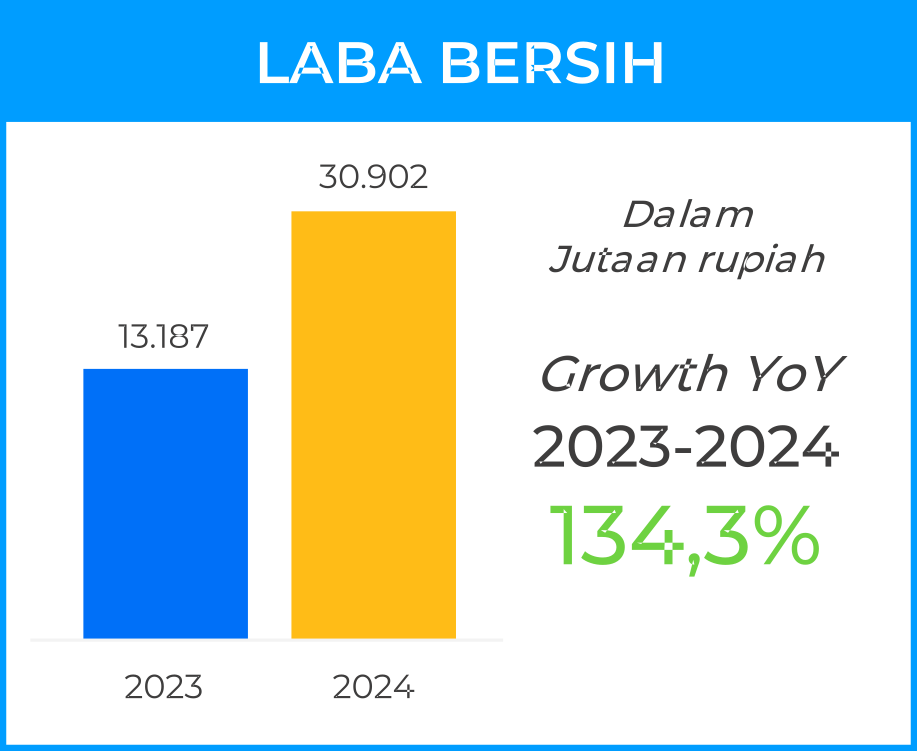

2024 Performance Highlights

The Company’s significant achievement is in the form of revenue of IDR 207,168 billion throughout 2024. This success shows the company’s commitment to maintaining sustainable business growth amidst increasingly tight industrial competition.

In the latest financial report, the Company recorded revenue growth of IDR 207,168 billion, up 66.45% from the previous year, reflecting operational efficiency and increasing demand for the company’s services.

Operating revenues

Financial Summary Table

(in billion Rupiah, unless otherwise stated)

| Income statement | 2024 | 2023 |

|---|---|---|

| Income | 207.168 | 124.461 |

| Cost of Goods Sold | (146.005) | (86.153) |

| Gross Profit | 61.162 | 38.307 |

| Profit Before Tax | 34.073 | 14.653 |

| Tax Burden | (3.171) | (1.465) |

| Current Period Profit | 30.901 | 13.187 |

| Financial Position Statement | 2024 | 2023 |

|---|---|---|

| Total Assets | 239.959 | 189.822 |

| Total Liabilities | 60.434 | 117.977 |

| Total Equity | 179.524 | 71.845 |

| Financial Ratio (%) | 2024 | 2023 |

|---|---|---|

| ROA (%) | 13 | 7 |

| ROE (%) | 17 | 18 |

| NPM (%) | 15 | 11 |

| DER (x) | 0.34 | 1.64 |

| DAR (x) | 0.25 | 0.62 |

Key Financial Data Overview Chart

Public Offering Prospectus

In 2024, the Company entered a new chapter by conducting an Initial Public Offering and becoming a public company by listing some of its shares on the Indonesian stock exchange with the code “NAIK” on November 13, 2024. The Company’s head office is located at Mutiara Taman Palem Office No. 53, Jl. Outer Ring Road Cengkareng, West Jakarta. Initial public offering of 750,000,000 shares with a nominal value of Rp20,- per share. Offering price of Rp107,- per share.

The following is the Public Offering Prospectus of PT Adiwarna Anugerah Abadi Tbk.

Shareholding Information

PT Adiwarna Anugerah Abadi Tbk

General Meeting of Shareholders (GMS)

The General Meeting of Shareholders (GMS) is a Company organ that has authority that is not given to the Board of Commissioners or the Board of Directors within the limits specified in the laws and regulations and the Articles of Association. This authority includes requesting accountability from the Board of Commissioners and the Board of Directors regarding the management of the Company, amending the Articles of Association, appointing and dismissing the Board of Directors and/or the Board of Commissioners, deciding on the division of tasks and authority of management among the Board of Directors and others.

In accordance with its implementation, the GMS consists of the Annual General Meeting of Shareholders (AGMS) which is held at least once a year no later than 6 (six) months after the end of the Company’s financial year, and the Extraordinary General Meeting of Shareholders (EGMS) which can be held outside the GMS time.

To discuss certain important issues concerning the company that cannot wait for the holding of the GMS, an EGMS can be held with the provisions as stipulated in the Articles of Association. Conditions that require an EGMS to be held include the following:

- Replacement of the Board of Commissioners and the Board of Directors before their term of office ends, either due to resignation and/or other reasons.

- The existence of a material transaction plan and/or conflict of interest as stipulated in applicable laws and regulations;

- Other material corporate plans, such as the repurchase of the Company’s outstanding shares, stock split, and rights issue.

Stages of GMS Implementation

The general stages of holding a GMS are as follows:

- The GMS invitation is made through the Company’s website, the Indonesia Stock Exchange website, and the Indonesian Central Securities Depository website (eASY.KSEI) which is carried out no later than 21 (twenty one) days before the date of the GMS, excluding the date of the invitation and the date of the GMS.

- Before making the invitation, the Company is required to make an announcement that the GMS invitation will be carried out through the Company’s website, the Indonesia Stock Exchange website, and the Indonesian Central Securities Depository website (eASY.KSEI) which is carried out no later than 14 (fourteen) days before the GMS invitation.

- Related to PTBA’s status as a public company and in order to ensure uniformity of information regarding the plan or implementation of the GMS, in accordance with the provisions of OJK Regulation Number 15/POJK.04/2020 concerning the Plan and Implementation of the General Meeting of Shareholders of Public Companies, the Company is required to submit the agenda of the Meeting clearly and in detail to OJK no later than 5 (five) working days before the Announcement.

- Furthermore, after the implementation of the GMS, the Company is required to submit the results of the Meeting no later than 2 (two) working days after the meeting is held to OJK and announce it to the public through the Company’s website, the Indonesia Stock Exchange website, and the Indonesian Central Securities Depository website (eASY.KSEI).

- Each share issued has 1 (one) voting right unless the Articles of Association stipulates otherwise.

Implementation of 2024 GMS

Summary of Minutes of the 2024 Financial Year AGM

Invitation to the Annual General Meeting of Shareholders of PT Adiwarna Anugerah Abadi Tbk for the 2024 Financial Year

Announcement of the Annual General Meeting of Shareholders of PT Adiwarna Anugerah Abadi Tbk for the Financial Year 2024

Implementation of 2025 GMS

Latest Updates From Adiwarna

Announcement of the Annual General Meeting of Shareholders of PT Adiwarna Anugerah Abadi Tbk for the Financial Year 2024